The subject of measuring market size comes up every few weeks in my interactions with startup founders, and one point I always raise is the difference between a top-down and bottom-up approach.

Top-Down

The top-down approach is the one you would traditionally link to business school case studies and startups going after large markets.

The approach involves going to a source of (often public) data and finding out how many X’s there are in the world, where X is your target consumer…be it a barber shop, web design firm or male under the age of 34.

The challenge with this approach is that unless you have a stack of cash from here to the moon, you have zero chance of reaching all of those X’s.

As a self-funded venture your best case will be to communicate with a single digit percentage of your market through online marketing and perhaps some cold calls and direct mail.

If you have funding coming out of your ears, maybe you’ll drop seven figures on a Super Bowl ad and reach into a double digit percentage of your market. Of course, the effectiveness of your funnel drops exponentially when you move to mass advertising. But it worked for a lot of the dot com’s in the early 2000s. Oh wait, no…that’s right, it didn’t.

Jokes aside, the top-down approach has its place in business plans and pitch decks commonly used to ask people for money.

Where they don’t belong is with a bootstrapped founder trying to figure out how many customers she can expect to reach next month on her shoestring marketing budget. In that case, bottom-up is a better choice.

Bottom-Up

There are many bottom-up approaches to sizing a market; I discuss the approach I use in my developer’s guide to launching a startup.

It involves using the Google AdWords Keyword Tool to estimate how many X’s are actually looking for your solution to their problem on a monthly basis.

And while this doesn’t give you an idea of the total market size, it does show you how many people you can reach right away if you nail your online marketing.

Sure, there is still a sea of prospects that can’t be reached online, but for self-funded startups it’s obvious that these days online marketing is a much better use of your resources than cold calling, direct mail, trade shows, etc…

I’m not going to go into detail on the approach here except to say that it uses the AdWords Keyword Tool to estimate how many prospects are searching Google for your kind of product each month. It then crunches those numbers together with an expected conversion rate and expected price to give you an idea of expected monthly revenue.

The thing is, the Google AdWords Keyword Tool is wrought with land mines. And I’ve realized over the past few weeks that many entrepreneurs are making the same mistakes, inadvertently bringing back results that make their market appear larger than it actually is.

This is a big deal, and one I hope to counter-act by looking at the four most common mistakes I see again and again when using the AdWords Keyword Tool.

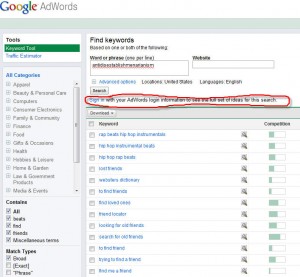

Mistake #1: Not Logging In

So you’ve decided to use the bottom-up approach to sizing your market. Sweet. Let’s hit the Google AdWords Keyword Tool and find out how many people are searching for our key marketing term.

Typically you would search for a term like “inventory software,” but for our new whizz-bang social media application it all depends on people searching for the longest word in the English language, antidisestablishmentarianism.

Don’t ask me why, you need funding to understand.

So first, make sure you’re logged in to your AdWords account. For some reason Google gives you limited (aka crap) results if you’re not logged in, with only a tiny warning about this.

Mistake #1: Log in!

Mistake #2: Using the Default Match Type

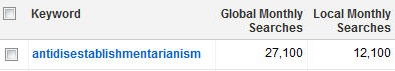

Next, enter your term and hit “search.”

“Oh man, 27,100 people per month search for antidisestablishmentarianism. This is precisely our target market. I’m counting the mad stacks of cash already! “

But hold on a sec. Did you take a peek at what kind of search you performed? Yep, way down in the lower left of the page there are three checkboxes, hidden away as if to intentionally lead you to believe your market is larger than it appears.

That’s mistake #2.

You don’t want broad match…you want exact match. If you are searching for the term “dog bites,” a broad match will match on any of the following:

- dog bites man

- man bites dog

- someone with a hot dog bites into it

In other words, this returns way more results than you’re looking for. So uncheck broad and check exact.

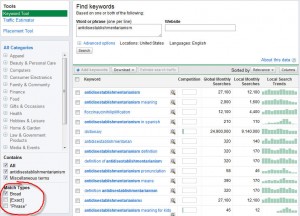

Mistake #3: Global Searches

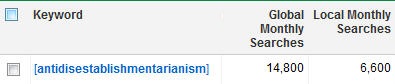

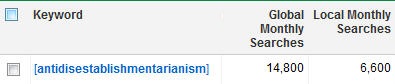

Ok, not too bad. We still show 14,800 people looking for this term.

But wait…those are global searches. This doesn’t mean what you think it means.

“Global searches are just people searching Google from around the world, right? Well, our application is for social media so anyone in the world can use it. 14,800, here we come!”

Except not.

The real story is that the global monthly search total includes those through every Google property, such as Google.com, Google.co.uk, Google.co.in, etc…

The challenge is that Google includes some pretty localized factors when it ranks websites in these “local” search engines. Rankings include factors like having the same top level domain (so .co.in for Google.co.in) and being hosted inside that country (to name a few).

Needless to say, local websites have the advantage here, which makes sense. This provides the most accurate results for people using that search engine.

Bad news for you. Good luck ranking in every Google search engine. It’s not going to happen. Cash in your chips and move on to #4.

Mistake #4: Local Searches

“Ok” you say reluctantly, “I can live with 6,600 monthly searches. Maybe we can’t rely on our freemium, advertising-based, viral revenue model, though. We might have to charge someone at some point…but we can make it work.”

Except for one last thing.

The Google AdWord Keyword Tool doesn’t show you how many visitors you would receive if you ranked #1 for this term. It seems like it should, but it doesn’t.

I have a number of sites that rank #1 for a number of terms, and almost none of them match this local monthly search value. It’s generally accepted that this value is higher than the number of uniques you will receive from ranking #1 for this term.

D’oh.

The rule of thumb (and it’s only a rule of thumb – your mileage may vary) is to take 40-60% of the keyword tool’s number as the actual number of unique visitors per month that you would receive if you ranked #1 in Google for this term. I tend to ballpark it at 50%.

3,300, here you come.